Review & Assessments

IDW S6 & Co. –

If a company finds itself in financial difficulty, banks and other funding partners require a financial recovery assessment, to enable them to provide further, legally watertight funding or to make decisions about restructuring measures. The Institute of Public Auditors in Germany (IDW) has defined the requirements of a financial recovery assessment in its S6 standard. This standard is established practice and accepted by all those involved in any financial recovery process. A financial recovery assessment must also take account of the latest FCJ jurisprudence in addition to the IDW standard. A financial recovery concept is required in order to structure any required funding for the next few years and get the company fit for the future.

A CENTUROS-authored financial recovery assessment not only serves to meet formal requirements, but also provides the company with substantial added value in the form of our extensive analyses and practically relevant action recommendations. Furthermore, if a company is in an advanced state of crisis, we examine whether there are grounds for a bankruptcy petition. This review helps the company’s legal representatives avert any liability risks. An IDW S11-compliant assessment is a binding appraisal of whether the company is insolvent (§17 InsO – German Insolvency Code) and/or over-indebted (§19 InsO – German Insolvency Code).

What needs to be audited?

Insolvency

The company is unable to meet its payment obligations that are due and this is not just a temporary payment stoppage.

Imminent Insolvency

The company’s financial plans and budgets reveal that future payment obligations can’t be met. There is no acute risk of insolvency.

Over-Indebtedness

The company’s liabilities exceed its assets and the Continued Existence Forecast is not positive. Here, assets are recognised as liquidation values.

Obligation to file for bankruptcy

Right to file for bankruptcy

Obligation to file for bankruptcy

Typical procedure in the case of

companies in an advanced state of crisis

Analysis of Asset, Financial

and Earnings Situation- Analysis of historical financial data

- Analysis of one-off effects and normalisation of earnings and financial situation

- Working capital analysis

Audit of Business

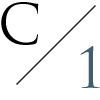

Plan Viability- Analysis of business environment, industry and customers

- Determination of the company’s market positioning

- Identification of crisis causes and potential

- Derivation of financial recovery strategy and mission statement for the restructured company

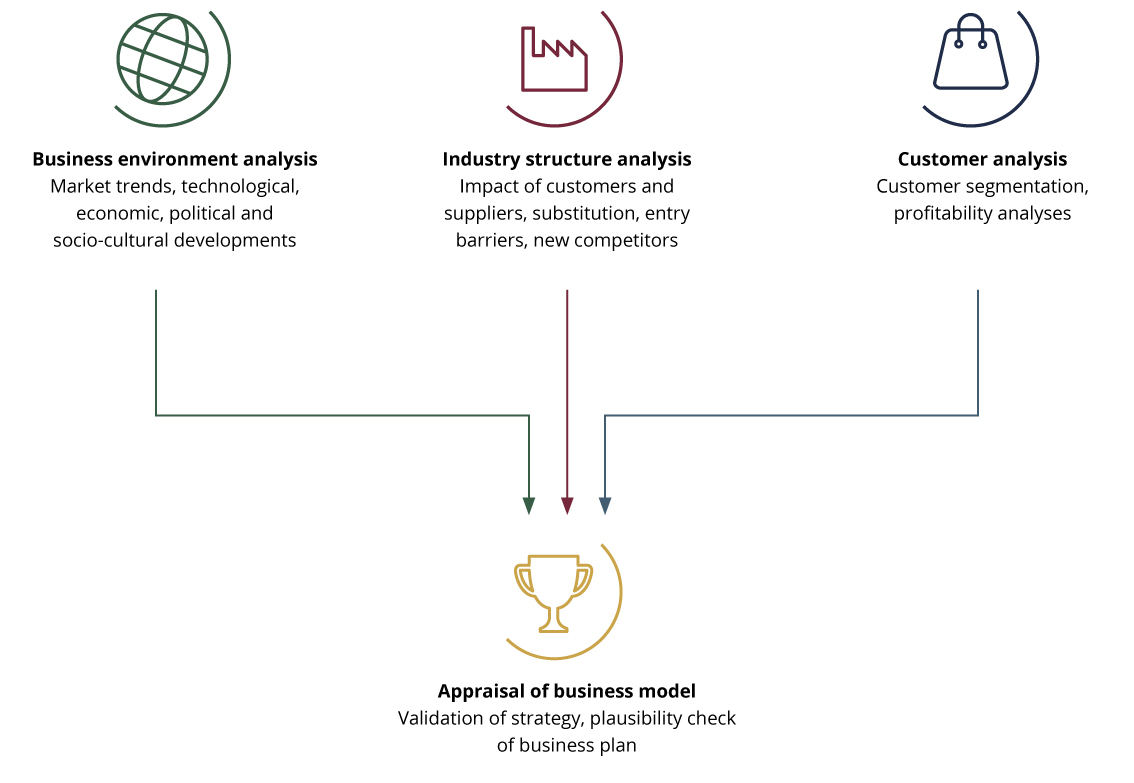

Digitalisation check

- Quality and quantity of data model

- Smart production

- Smart products

- Smart processes

- Open minded digitalization culture

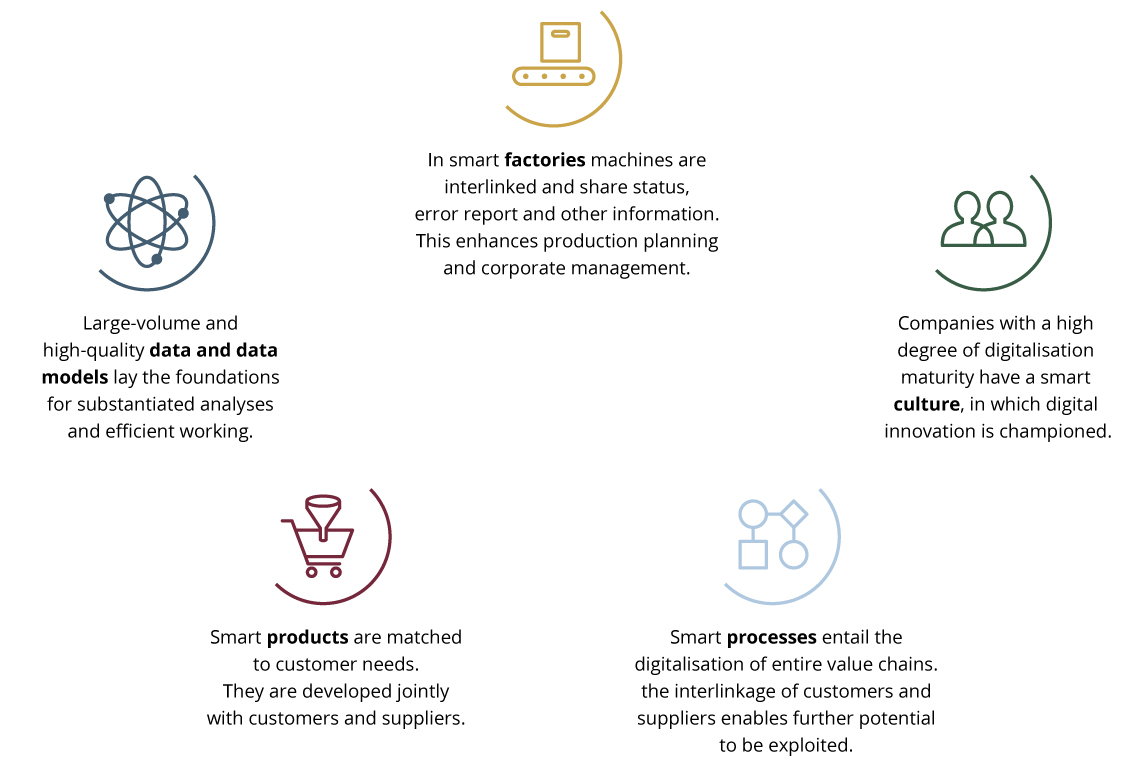

Validation of Business Plan

- Validation/derivation of integrated business plan

- Preparation of client-specific planning tool

- Description of action to be taken and implementation status

- Analysis of planned earnings and liquidity effects to achieve earnings targets

- Sensitivity analysis of KPIs on earnings and liquidity situation (scenarios)

- Statements about formal criteria

Implementation

- Implementation of agile project management tool

- Active support for and management of action implementation (if necessary, appointment of a CRO)

- Putting progress monitoring mechanisms and fiscal variance analyses in place